This is the first of a series of articles intended to help AFTA Members understand their business insurance needs.

Did you know?

1,597m*1,597 million tonnes of cargo is moved across Australian wharves in 2015–16. |

$218.9b*The value of Australia’s exports by sea was $218.9 billion in 2015–16. |

99%**99% of Australian exports use sea transport. |

* Department of Infrastructure, Regional Development and Cities, Statistical report, Australian sea freight 2015-2016, 2018

** Department of Infrastructure, Regional Development and Cities, Maritime, 2018

What is marine transit insurance?

Marine transit insurance helps protect your business from loss or damage to your goods while they are being imported, exported or transported within Australia.

Who should consider it?

Marine transit insurance is important for any businesses involved in sending or receiving goods to or from anywhere in the world.

What can it cover?

The type of cover you choose will vary based on your specific needs. The most common is an Annual Accidental Damage policy covering physical damage that occurs as a result of an unexpected and non-deliberate external action. Also available is a defined events style policy covering specified perils (impact, collision, overturning, fire, malicious damage, etc).

Is the seller or buyer responsible for organising insurance?

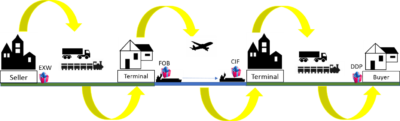

The following diagram tracks a normal shipment from seller to buyer.

The responsibility for insurance on the goods throughout the shipment is often shared between both the Seller and Buyer and depends on the Delivery Terms agreed. The diagram shows the point where the sellers insurance obligation terminates for several common Delivery Terms. There are ten different Delivery Terms used in Marine transport, each terminating the insurance obligation of the seller at different stages of the Shipment.

Should I consider arranging my own marine transit Insurance policy?

If you are importing goods, exporting goods or sending your goods within Australia – Yes.

Your own Marine Transit policy will provide you with the necessary peace of mind knowing your goods are adequately insured during their entire shipment.

Who can I contact for further advice?

AFTA recently launched a partnership with Network Insurance Group, a leading Australian-owned insurance broker, to provide insurance and risk advice to AFTA members. They are able to review members’ marine and other risks, and often secure cover at a reduced cost for members.

Contact Your AFTA Member Adviser: James Finucane

m: 0407 954 105 | e: afta@steadfast-irs.com.au

We first contacted Network Insurance Group for our business insurance last year, but unfortunately, the renewal date was too close for them to do a full audit on the business, but early indications were good and Network Insurance Group’s keenness to help seemed first class. We thought we would give them a go when our transit/cargo insurance became due as it was separate and had been with a long term partner to our business.

To our surprise, their quote was cheaper and the terms were better. In fact, we increased some levels of cover two-fold thanks to the new rate and terms. Of course, we gave the right of reply to our existing provider and they did reduce their quote substantially, but in the end, we saved more than 30% for better cover and knowing that a percentage of the brokers’ fee went back to AFTA was the icing on the cake.

We will definitely be giving them a go at our business insurance when due and I would suggest anyone looking to save money at least make contact as their service was slick and they made the entire process easy.

The Shimano team have worked with Network Steadfast as our insurance broker for over 20 years. We are proud of our partnership which is based upon a superior level of service, professionalism and above all, trust. Network Steadfast has the leverage and expertise we’d expect from a large national broker, but the personal, relationship focus of a family business. They take the time to understand our business and leave no stone unturned when it comes to ensuring we understand our risks and insurance options.